The Medicare Alphabet

Welcome to The Medicare Alphabet – your guide to navigating the complex world of Medicare. We know that Medicare can be confusing, so let’s break it down into simple terms.

First things first, make sure you elect your Medicare coverage before it begins. This will help you avoid costly delays and penalties down the road.

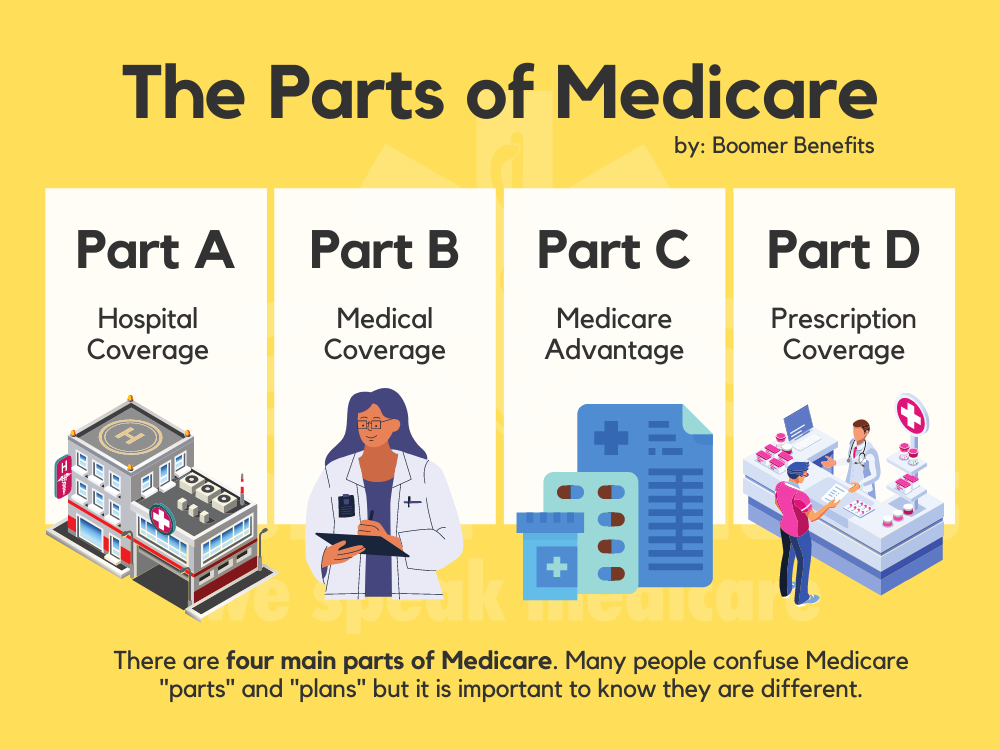

Medicare has four parts – A, B, C, and D. Parts A and B are also known as Original Medicare. Part A covers hospital care, and part B covers medical care. But that’s only part of the story. Part D covers prescription drugs, and part C is Medicare Advantage.

Part A – Hospital Coverage

Part A is the only part of Medicare that automatically starts the month of your 65th birthday, and for most beneficiaries, there is no premium. However, there is a deductible for each hospital admission, and it only covers up to 90 consecutive days.

Beneficiaries who paid Medicare (FICA) taxes for at least 40 quarters throughout their working years qualify for premium-free part A. Although for most it doesn’t cost anything to have, it does cost money to use.

Medicare part A only covers hospital stays. There is a $1,600 deductible for each hospital admission and only covers up to 90 consecutive days, with a certain number of lifetime reserve days available if that threshold is exceeded.

Part B – Medical Coverage

Part B is required for most people on Medicare and covers medical care. However, it’s not premium-free, and for 2023, the premium is $164.90 per month. There is also a deductible and coinsurance cost share for covered services.

Once the deductible is reached, Medicare will only pay 80% of covered services, with no limit on how much the beneficiary may have to pay for their care.

As you can see with a premium, deductible, and coinsurance, Medicare part B only covers so much of your medical care, and the rest is on you.

What’s more, if you don’t have Medicare part B or creditable coverage through you or your spouse’s retirement or employer group health coverage, you could pay a penalty every month for the rest of your life.

Part D – Prescription Drug Plans

Yes, we know our ABC’s, but we’ll save part C for last, for reasons that will become clear later. If you’d like to skip ahead you can visit our supplemental plans page for information about Medicare part C and Medicare supplement plans.

Medicare part D covers what Original Medicare does not – prescription drugs. Many taxpayers don’t know that Medicare will not cover their prescriptions by itself.

Instead beneficiaries will need to choose from available part D prescription drug plans through private insurers such as Humana, Cigna, or Aetna.

Medicare part D prescription drug plans typically have a monthly premium, usually less than $50, but possibly more depending on your geographic location and prescription drug needs.

Plans may also have deductibles, copays, and coinsurance cost share as well. Many plans employ cost control measures such as having a covered formulary of drugs, limiting quantities, requiring preauthorization, or establishing tiers of pricing so more expensive medications have higher a cost share.